- China's zero-Covid policy has significantly reduced oil demand in the country and is one of the main reasons oil prices have been in decline since June.

- Now that China has officially ended its zero-Covid strategy, it will have to endure a spike in infections and then is expected to boost global oil demand by 1 million bpd.

- A recent article by the BMJ and reports of hospitals filling up in China suggest that its spike in infections may be faster and deadlier than many had expected.

In December 2021, the International Energy Forum (IEF) warned of price shocks, scarcity, and growing energy poverty due to two years of “large and abrupt underinvestment in oil and gas”. Most of the world was beginning to open up after the pandemic, energy demand was climbing, and the price of oil, gas, and electricity was climbing with it. Then, in February 2022, Russia invaded Ukraine and the price of oil soared past $100. It is easy to forget, 10 months on, just how vulnerable global energy markets were before Russia’s invasion. It is also tempting to believe, with oil prices having now fallen all the way back to where they were at the beginning of the year, that the energy crisis is nearly over. In reality, energy prices haven’t fallen because of a flood of new supply or the creation of a new robust energy system. Prices are down because demand for energy has decreased due to a global economic slowdown and due to China’s battle with Covid. In recognizing this fact, it becomes clear why Daniel Yergin believes oil prices could climb back up to $121 if China “gets over Covid”, and it is looking increasingly likely that China will soon do just that.

In the first 10 months of 2022, China’s refineries processed 1.8 million barrels per day (bpd) fewer than the pre-pandemic five-year trend for 2015-2019 would have suggested. In that same period, China produced 0.6 million bpd of jet fuel, down from 1.1 million bpd in 2019. Those numbers give an idea of the level of oil demand destruction the pandemic caused in China, and the amount of demand that could come online once China ‘gets over’ Covid as Yergin puts it. With China having officially ended its zero-Covid strategy, its ‘exit’ from Covid has begun and there is no going back. The only question now is how quickly China’s oil demand will bounce back.

Reuters analyst John Kemp explains the situation neatly, saying that China’s recovery will eventually “boost oil consumption by more than 1 million barrels per day” but that China will first have to “endure a massive exit wave of infection”. That exit wave will temporarily depress consumption even further. Kemp’s analysis suggests two scenarios, the first is an uncontrolled exit wave that lasts two to four months, and the second is a controlled exit wave that lasts three to six months. Although timelines may vary, the general consensus is that Chinese oil demand is on an uncomfortable but certain road to recovery. If it is a case of timelines, then a recent BMJ article would suggest the road to recovery is going to be fast, furious, and deadly.

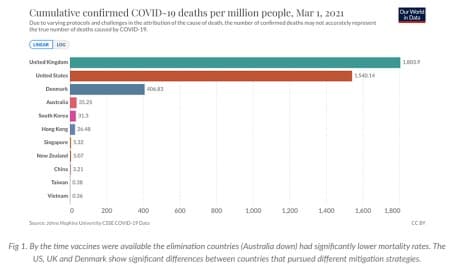

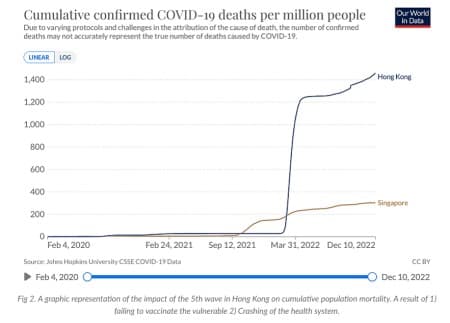

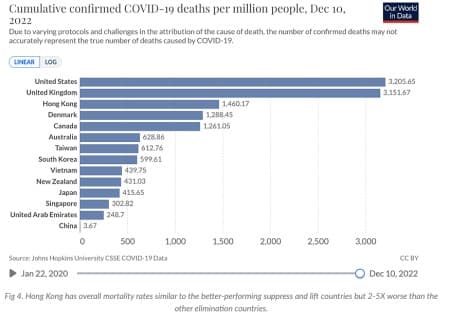

The BMJ compares the recovery of two other Covid-zero countries, Singapore and Hong Kong, to suggest how China’s exit might unfold. Like China, both Singapore and Hong Kong succeeded early on in the pandemic in keeping mortality rates lower than those countries that didn’t attempt to eliminate Covid.

In exiting Covid, however, the difference between Singapore and Hong Kong was stark. Singapore focused on early vaccination of the most vulnerable and developed a clear and well-communicated plan to transition from zero-Covid. Its transition took six to twelve months and resulted in a relatively low-mortality rate. Hong Kong, by contrast, pivoted from zero-Covid without any clear messaging, with low levels of vaccination, and quickly saw the health system overloaded. The fifth wave in Hong Kong was far more aggressive and far faster than that of Singapore. The end result was that a resident of Hong Kong was almost five times as likely to have died of Covid over the last three years than a resident of Singapore.

Currently, it appears China will be far nearer to Hong Kong than Singapore in its exit from Covid-zero. According to the World Health Organization, China’s hospitals are already filling up, leading to fears that its health system will be overwhelmed. Meanwhile, just as in Hong Kong, there has been no clear messaging and no attempts at mitigation. If the BMJ’s analysis is accurate, then it would appear that Kemp’s “uncontrolled wave” scenario is already underway in the country. Tragically, China’s Covid recovery may be far faster than expected.

By Josh Owens for Oilprice.com

More Top Reads From Oilprice.com:

Josh Owens

Josh Owens is the Content Director at Oilprice.com. An International Relations and Politics graduate from the University of Edinburgh, Josh specialized in Middle East and…

More InfoChina's Fast And Deadly Road To Covid Recovery - OilPrice.com

Read More

No comments:

Post a Comment